Encyro Update: New Features to Save You Time

Following up on the August 2024 update, we have another update to address feedback received and to add additional functionality. You can now customize the navigation menu, use drag-drop to move items, copy-paste e-sign fields, and take advantage of additional enhancements.

Best Client Portals for Accounting and Finance

Can I use the client portal that came with my website? Or choose one of the old brands? The wrong secure client portal could cost you dearly in client retention, as well as security. We compare 11 client portals and additionally discuss 7 portal alternatives (such as DropBox) for accountants and tax practitioners.

Encyro Successfully Completes HIPAA Compliance Audit

Encyro Inc is pleased to announce that it has successfully completed an audit of its data security and privacy practices by Compliancy Group, an independent third-party, to verify Encyro's compliance with all federally mandated and necessary regulatory standards outlined in the HIPAA Privacy Rule, HIPAA Security Rule, HIPAA Breach Notification Rule, HIPAA Omnibus Rule, and HITECH.

Best Email Encryption Services for Small Business

(Updated August 20, 2024 to update links.) Can I use any free email encryption service? Make the wrong choice and you could end up with a service where resetting a password causes all your past emails to be unreadable (yes, these exist, and for good reason). Some assume that all your email recipients are on a corporate email server.

How Encyro Helps You Comply with HIPAA, GDPR, GLBA, IRS Pub. 4557, PCI-DSS ...

Encyro helps you safeguard customer data to help you meet many privacy and security regulations and guidelines. This article shows you how Encyro helps you meet your compliance requirements for HIPAA, GDPR, GLBA, IRS 4557, PCI-DSS and other standards.

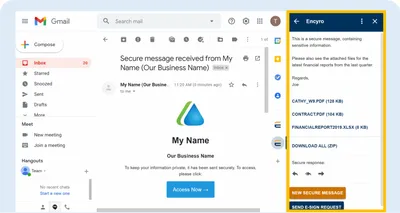

Use Encyro from Gmail

Install the Encyro addon for Gmail and read incoming secure messages or uploads directly from within Gmail. You may also download files and securely reply, reply-all, or forward a secure message. The addon also lets you send secure messages and electronic signature requests from within Gmail.

Dynamic File E-Sign Templates

Encyro E-Sign templates let you use a new file each time you send an electronic signature request. Use this feature for e-sign requests where a new file is generated to be signed for each client but the placement of the signature boxes and other items to fill is is the same. So you reuse all the boxes for signatures, text, or other items to fill in, KBA settings, as well as the e-sign request configurations such as reminders, login types, signature types, email subject, and introductory text.

[Video] Easy E-Sign for 8879 (KBA)

Meet IRS KBA requirements (Pub. 1345) for electronic signatures on Form 8879. Make it easy for clients. And cost-effective for you. Encyro's KBA meets IRS Publication 1345 requirements but keeps costs down by taking advantage of the ID check you performed during your own client onboarding.

Form 8879 IRS-Compliant Electronic Signature

Tax professionals filing electronically need to get IRS form 8879 or form 8878 signed by their clients. However, traditional e-signature services may not support the IRS electronic signature requirements, specifically the knowledge-based authentication (KBA) requirement for electronic signatures performed remotely.

Are You on the Accountants' Wall of Shame?

Recent incidents at small accounting firms have many accountants worried, and for good reason. For no fault of yours, the entire reputation and goodwill you have built up for your accounting practice could suddenly be at grave risk. How does it happen? What can you do to protect yourself?

Auto-organize Your Documents

If your business receives email from clients, it is likely that you or your client had trouble locating a document that was already sent. Either you wasted their time or they wasted yours. If you use your personal email to send or receive documents from your service providers such as accountants, mortgage brokers, landlords, tenants, household employees, legal counsel or others, it is likely that you had trouble finding something they already sent.

Avoid Printing, Copying, and Mailing

Sending paper documents is expensive! Printing, copying and mailing are real costs for any business that sends paper documents to clients. There is a huge time cost to taking printouts, printing addresses, sealing envelopes, stamping and mailing. Not to mention the overheads of maintaining the printing equipment, space costs for the paper files, and security overheads for them.

Convenience Plus Security

Email is convenient. You do not need to create an account for your client or recipient - they already have an email address. But email is not secure. Client portals are secure. But a hassle to convince the client to sign up. How can we get the best of both worlds?

Data Security for Tax Preparers Overview

Why did IRS release Pub. 4557, titled Safeguarding Taxpayer Data? Because tax preparers are extremely juicy targets for identity thieves. The client information containing social security numbers and all the related personal data is super valuable on the black market. Learn how you can stay protected.

Export Contacts: Make it Easy to Send Secure to Any Email Contact

Want to know the easiest way to send secure messages to any contact in your email account? You probably have a bunch of contacts who you have been emailing. Learn how to import all those contacts to your Encyro account and make sending secure messages even easier.

Fully Automatic Encryption

We take care of encryption for you. You need not save any encryption keys, install special software or configure any security settings to use Encyro. Messages and attachments are encrypted at your device, so they never travel across the Internet without encryption.

How Can Solo Accountants Make $500k a Year

Only a small fraction of CPAs make $500k a year, but it is possible. And it is faster to achieve in your own firm than by working for a large public accounting firm or getting a corporate job in the industry. To make big money in a solo practice or a small firm, your strategy will have to differ greatly from that of the the big firms. Review these ideas to get started.

How to force Windows 10 to lock itself after inactivity, for all users

One of the aspects of securing your computers is to ensure that it locks itself after a period of inactivity. So, if the PC is idle, which means the user has likely left it unattended for a while, we want the screen to be locked. These instructions show you how.

How to Send Files and Messages Securely?

Want to securely share files with clients? Use Encyro to make it easy to send and receive files securely, without having to create client accounts or installing encryption certificates. Comply with FTC requirements for financial services (accountants, tax pros, mortgage brokers, lenders, financial advisors, retirement planners, appraisers, property managers, and others).

How to Turn on BitLocker in Windows 10

If your PC computer is lost or stolen, having a password does not protect your data. The thief need not even login to your computer - they can simply remove the hard drive and connect it to a different computer. However, if the data is encrypted, it is practically impossible for the thief to retrieve your sensitive files. Learn how to turn on encryption.